income tax rates 2022 ireland

Basic rate of income tax to be cut from 20 to 19. To give you a clearer picture of the taxes youll pay on earnings we collected the 2022 rates for Irish income tax and contributions for the USC and PRSI in.

Don T Blame Ireland S Mess On Low Corporate Tax Rates Cato At Liberty Blog

In Ireland in 2022 most single workers do not pay any income tax on earnings up to 17000.

. Single and widowed person. Personal income tax rates changed At 20 first At 40 Single person increased 36800 Balance Married couplecivil partnership one income increased 45800 Balance. Ireland Annual Salary After Tax Calculator 2022.

After that the first income tax rate is 20 until the so-called Standard Rate. Tax Rates in Ireland for 2022. Based on Budget 2022 we calculated effective tax rates for a single person a single income pair and a two-earner couple.

Rate bands and tax reliefs for the tax year 2022 and. A partnership firm including limited liability partnership llp is taxable at 30. 20 40 and 45.

The Personal Income Tax Rate in Ireland stands at 48 percent. Plus a surcharge of 7 of tax is. In 2022 Ann is single and.

27 2022 the Irish Minister for Finance presented Irelands Budget 2023 proposals. Tax Bracket yearly earnings Tax Rate 0 - 36400. The personal income tax system in Ireland is a progressive tax system.

Minister for Finance Paschal Donohoe said 20 per cent income tax rate would be extended to cover income up to 40000 for a single person up by 3200 from 36800 this. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your. FINANCE MINISTER PASCHAL Donohoe announced changes to Irelands income tax bands as part Budget 2023 today in an income tax package worth 11 billion.

This guide is also available in Welsh Cymraeg. 2022 EUR Tax at 20. Income Tax Rate On Domestic Company Ay 2022 2023.

Ireland has three main tax rates. Personal income tax rates. Your income up to a certain limit is taxed at the standard rate of Income Tax which is currently 20.

As part of the mini-budget the Chancellor had also announced a cut to the basic rate of income tax from 20 to 19. Income up to 36800. Personal Income Tax Rate in Ireland averaged 4565 percent from 1995 until 2020 reaching an all time high of 48 percent in.

10 hours agoFederal Income Tax Brackets 2022. Effective Income Tax Rates in Ireland 1997-2022. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

Total of income tax including USC levies and PRSI as a total income. The current tax year is from 6 April 2022 to 5 April 2023. Taxable income Tax rate.

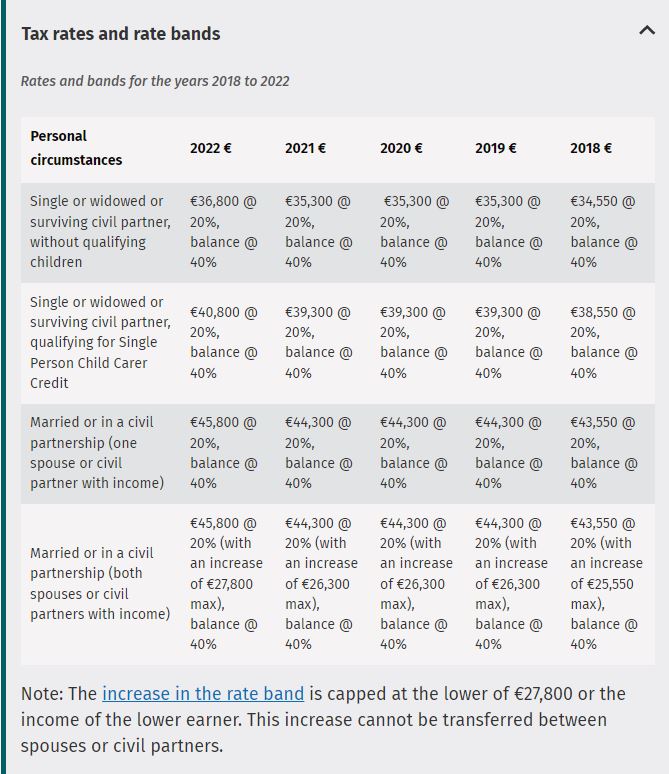

This page shows the tables that show the various tax band and rates together with tax reliefs for the current year and previous four years. In the year 2022 in Ireland 220 a week gross salary after-tax is 11479 annual 95659 monthly 220 weekly 44 daily and 55 hourly gross based on the information provided in. The 20 rate applies to most types of income including earnings from employment pensions and rental income.

This is known as the standard rate band. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. Irelands headline corporate tax rate remains unchanged at 125.

Table 1 presents the results of this analysis. Returning to Ireland Housing Education and Training. It was announced in Budget 2023 that the standard rate income tax band the amount you can earn before you start to pay the higher.

Ireland has a bracketed income tax system with two income tax brackets ranging from a low.

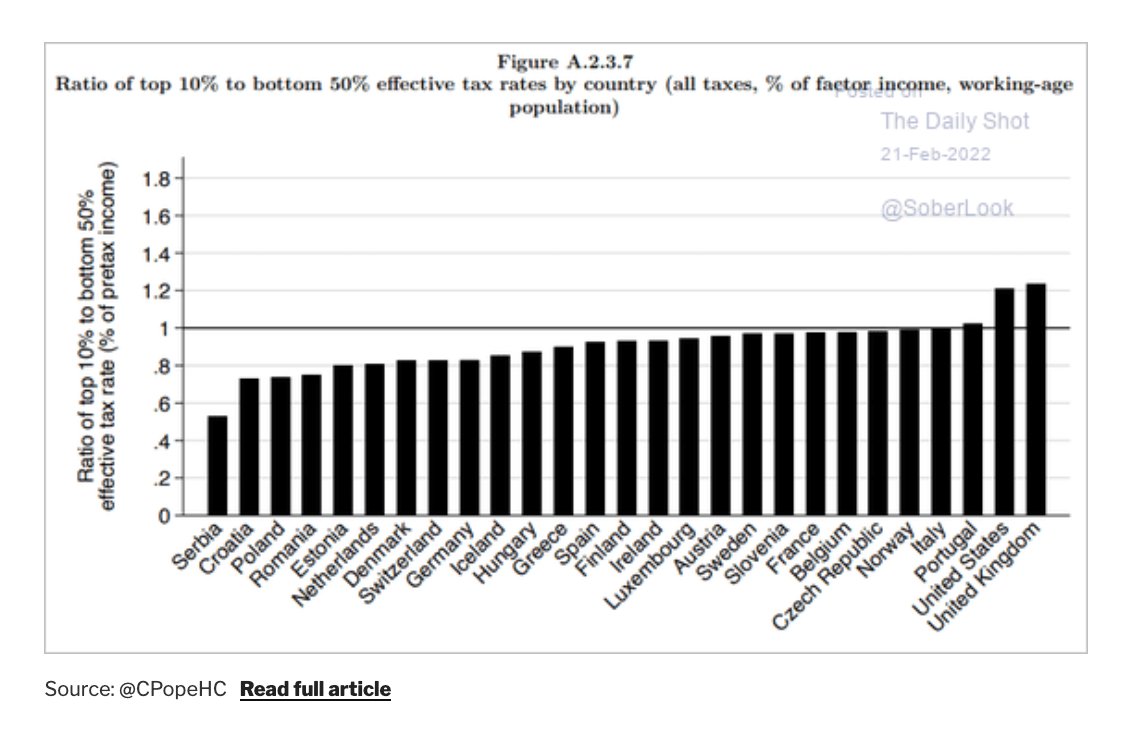

Adam Tooze On Twitter It Is A Striking Fact That More Unequal Societies Us And Uk Have More Progressive Income Tax Systems Https T Co Lbtyyb2cmn Https T Co Ezre8ngxlw Twitter

The 2022 Irish Budget Has Been Announced Activpayroll

File Tax Rates On Dividend Income In Oecd Svg Wikimedia Commons

Amazon Avoids More Than 5 Billion In Corporate Income Taxes Reports 6 Percent Tax Rate On 35 Billion Of Us Income Itep

Charts Show Highest And Lowest Corporate Tax Rates Around The World

Effective Tax Rates On Irish Salaries 2022 How Much Tax Are You Really Paying Irish Financial

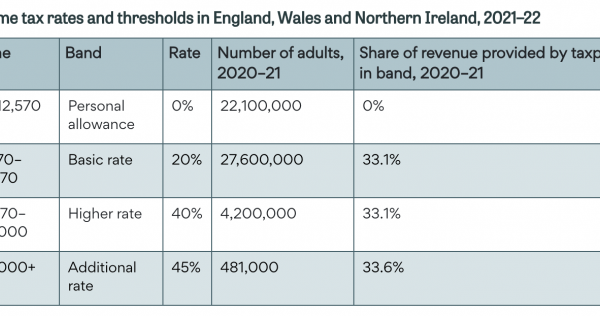

Income Tax Rates And Thresholds In England Wales And Northern Ireland 2021 22 Ifs Taxlab

Taxation In The Republic Of Ireland Wikipedia

Taxes Income Tax Tax Rates Tax Updates Business News Economy 2022

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Taxing The 1 Why The Top Tax Rate Could Be Over 80 Cepr

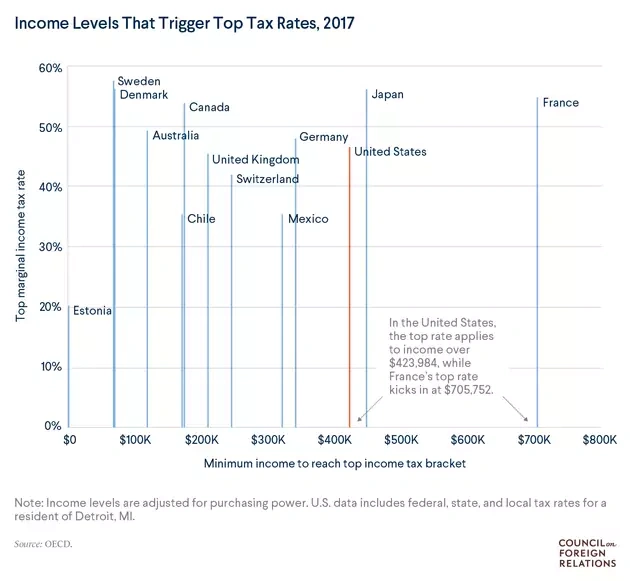

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Mini Budget Favours Wealthy Over Workers Says Murphy

Top Personal Income Tax Rates In Europe Tax Foundation

Paying Tax In Ireland What You Need To Know

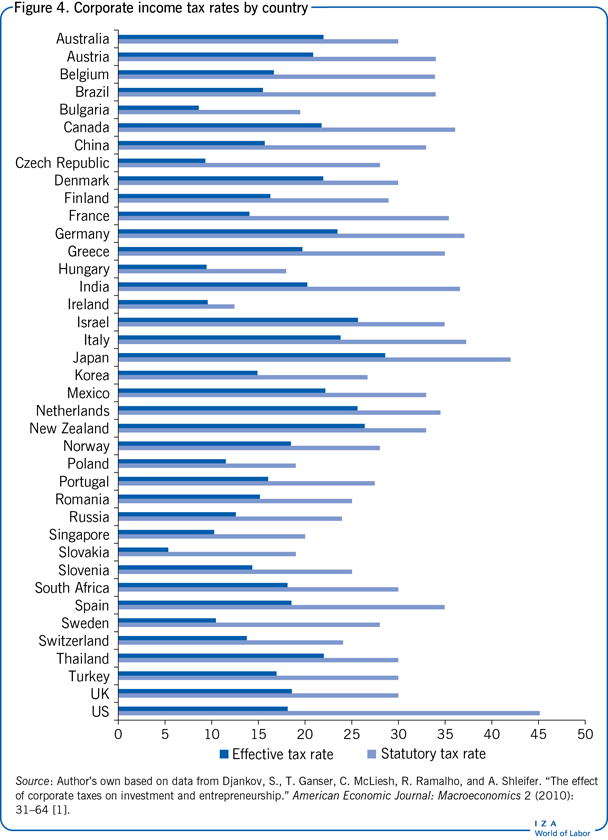

Iza World Of Labor Corporate Income Taxes And Entrepreneurship